is car finance interest tax deductible

You can deduct the interest paid on an auto loan as a business expense using one of two methods. The answer to is car loan interest tax deductible is normally no.

How Much Of Your Car Loan Interest Is Tax Deductible Bankrate

You may also get a tax deduction on the car loan interest if youve taken out a chattel mortgage where the vehicle acts as the security for the loan.

. Thus as the interest on car loan is allowed to be treated as an expense this reduces. Typically deducting car loan interest is not allowed. 1 Best answer.

Interest paid on a loan to purchase a car for personal use. You cant deduct your car payments on your taxes but if youre self-employed and youre financing a car you use for work all or a portion of the auto loan interest may be tax deductible. As the interest on car loan is allowed to be treated as an expense this reduces the taxable profit which in turn reduces the Income Tax to be paid.

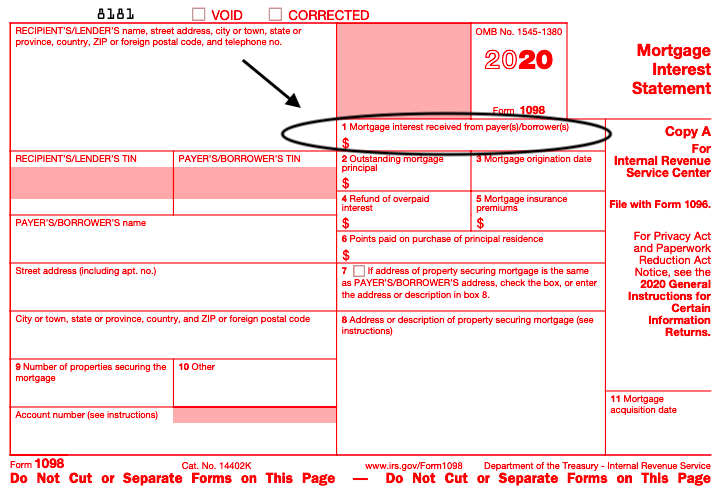

Car limit There is a limit on the cost you can use to work out the depreciation of passenger vehicles except motorcycles or similar vehicles designed to carry a load of less than one. You cant get a tax deduction on interest from auto loans but mortgages and student loans do allow you to take a tax break under certain conditions. This is why you need to list your vehicle as a business expense if you wish to deduct the interest.

If the vehicle is being used in part for business as an employee and the expenses are being deducted as an itemized deduction. Credit card and installment interest incurred for. Experts agree that auto loan interest charges arent inherently deductible.

Payments towards car loan interest dont count as a deduction unless the car being used is for business purposes. Tax-deductible interest is the interest youve paid for various purposes that can be subtracted from your income to reduce your taxable income. However if the vehicle was used for a business purpose you may be able to deduct some or all of the cost against.

For vehicles purchased between December 31 1996. What types of vehicle expenses are NOT tax deductible. Deducting interest for financed vehicles.

When you use a passenger vehicle or a zero-emission passenger. Not all interest is tax-deductible. Less 10 Interest on Car Loan 10 of Rs.

It can also be a vehicle you use for both. 10 x the number of days for which interest was payable. Interest paid on personal loans is not tax deductible.

For example if you use the vehicle 50 of the time for business purposes you can only deduct 50 of the loan interest on your tax returns. But you can deduct these costs from your income tax if its a business car. The expense method or the standard mileage deduction when you file your taxes.

However LoanMart has competitive interest rates and long repayment terms so you can pay off your loan FAST which can be a. Car loan interest would be deductible if the vehicle was used for self employment or in the service of an employer but it is not deductible for personal use. Is Car Loan Interest Tax Deductible.

In this case neither the business portion nor the. June 7 2019 301 PM. But there is one exception to this rule.

More specifically if you borrowed money to buy a car you may well be asking are car loan payments tax deductible The answer to this is possibly but it depends on a number of. Types of interest not deductible include personal interest such as. To deduct interest on passenger vehicle loans take the lesser amount of either.

The interest on a car title loan is not generally tax deductible. When you finance a new vehicle. Is Car Loan Interest Tax Deductible.

Interest on vehicle loans is not deductible in and of itself. If you use your car for business purposes you may be allowed to partially deduct car loan. The amount you can deduct will depend on how many miles you drive for business.

On a chattel mortgage like a property mortgage youre listed as the cars owner allowing you to claim the car loan on your. This means that if you pay 1000. Car loan interest would be deductible if the vehicle was used for self employment or in the service of an employer 11.

In total your deduction of state and local income sales and property taxes is limited to 10000.

Use The Interactive Home Loan Emi Calculator To Calculate Your Home Loan Emi Get All Details On Interest Payable And Tenure Us Home Loans Loan Calculator Loan

How Much Of Your Car Loan Interest Is Tax Deductible Bankrate

Infographic Is My Move Tax Deductible We Move Your Life Tax Deductions Deduction Infographic

How Much Of Your Car Loan Interest Is Tax Deductible Bankrate

Is Buying A Car Tax Deductible In 2022

On Is Student Loan Interest Tax Deductible R Personalfinancecanada

Why Your Small Business Loan Interest Is Tax Deductible Funding Circle

How Much Of Your Car Loan Interest Is Tax Deductible Bankrate

To Learn More About Your Business 39 S Taxes And The Deductions That You Might Take Contact Us Today By Leav Credit Card Interest Tax Deductions Business Tax

How To Calculate Your Student Loan Interest Deduction Student Loan Hero

Tax Deductions For Home Mortgage Interest Under Tcja

Mortgage Affordability Tax Benefits Payoff Strategies Mortgage Mortgage Interest Rates Debt To Income Ratio

Irs Tax Forms Infographic Tax Relief Center Irs Tax Forms Irs Taxes Tax Forms

Haryana Employment Exchange Global Employment Usa Full Employment 5 Employment Law For Human Resource Business Tax Business Finance Business Marketing

How Much Of Your Car Loan Interest Is Tax Deductible Bankrate

Figure B Employe When Are Transportation Expenses Deductible Deduction Business Temporary Work

10 Things You Should Never Deduct From Your Taxes All Time Lists Best Car Insurance Car Insurance Online Cheap Car Insurance

How To Claim Your New Car As Tax Deductible Yourmechanic Advice

Can I Write Off The Interest On My Rv Loan On My Taxes Blog Nuventure Cpa Llc