colorado estate tax exemption

In 200 Colorado voters amend6 section 35ed of article X of the Colorado Constitution. How does selling a home affect taxes.

What You Need To Know About The 11 Million Estate Tax Exemption Going Away

So you are aware that there is no estate tax in Colorado.

. Seniors andor surviving spouses who qualify for the property tax exemption must submit an. Fifty percent of the first 200000 in actual property value is exempt from property taxation. There is no estate or inheritance tax collected by the state.

The Financial Services Manager or designee may upon the receipt of a properly completed exemption application grant an exemption from the RETT after the deed has been recorded. The exemption for that tax is 1170 million for deaths in 2021 and 1206 million in 2022. However Colorado residents still need to understand federal estate tax laws.

The Colorado Homestead Exemption Amount. Colorado estate tax applies whether the property is transferred through a will or according to Colorado intestacy laws. Provides a surviving spouse with shelter.

1 inheritance taxes which are. Colorado estate tax limit. If the Colorado Department of Revenue determines that an organization qualifies the organization will receive a Certificate of Exemption that authorizes it to purchase items and services.

Residential Properties Specific Forms For Charitable-Residential Properties Additional Forms Late Filing Fee Waiver Request Remedies for. The Exemptions Section is responsible for determining qualification for exemption from property taxation for properties that are owned and used for religious charitable and private school. Under the Colorado exemption system homeowners can exempt up to 75000 of their home.

Colorado real estate transfer tax laws vary throughout the state so buyers should consult a local real estate professional for specific information. Carefully review the guidance publication linked to the exemption listed below to ensure that. Real estate transfer taxes are.

Property from the estate in the form of cash in the amount of or other property of the estate in the value of thirty thousand dollars in excess of. Heres a look at the Taxpayer Relief Act of 1997 and 1031 tax-deferred exchange rules in Colorado. 2016 Colorado Revised Statutes Title 39 - Taxation Property Tax Article 13 - Documentary Fee on Conveyances of Real Property 39-13-104.

The amendment and subsequent legislation expanded the senior property tax exemption to include. You are the current owner of record and you have owned the property for at least 10 consecutive years prior to January 1 of the tax year for which you. When it comes to federal tax law.

Application for Property Tax Exemption. Some states have decided to recently enact statutes to tax estates based on a. See what to expect.

The Colorado estate tax is based on the state. Provides an exemption from property. While federal law still imposes estate taxes on certain estates only.

Certain products and services are exempt form Colorado state sales tax. There are three types of taxes imposed on the transfer of assets at death. Prevents a forced sale of a home to meet demands of creditors.

The Colorado House of Representatives approved legislation Thursday to exempt period products and diapers from sales tax sending it to the state Senate for consideration. For more articles see Bankruptcy Exemptions. The state constitution authorizes the general assembly to lower the maximum amount of the actual residential value of residential real property that is subject to the senior.

Even though there is no estate tax in Colorado you may still owe the federal estate tax. The Colorado Homestead Law. Colorado estate tax planning.

/How-Is-the-Gift-Tax-Calculated-3505674-v2-HL-cf2d3bd9ac04413ba108e6b0a44f0f39.png)

Gift Tax How Much Is It And Who Pays It

What You Need To Know About The 11 Million Estate Tax Exemption Going Away

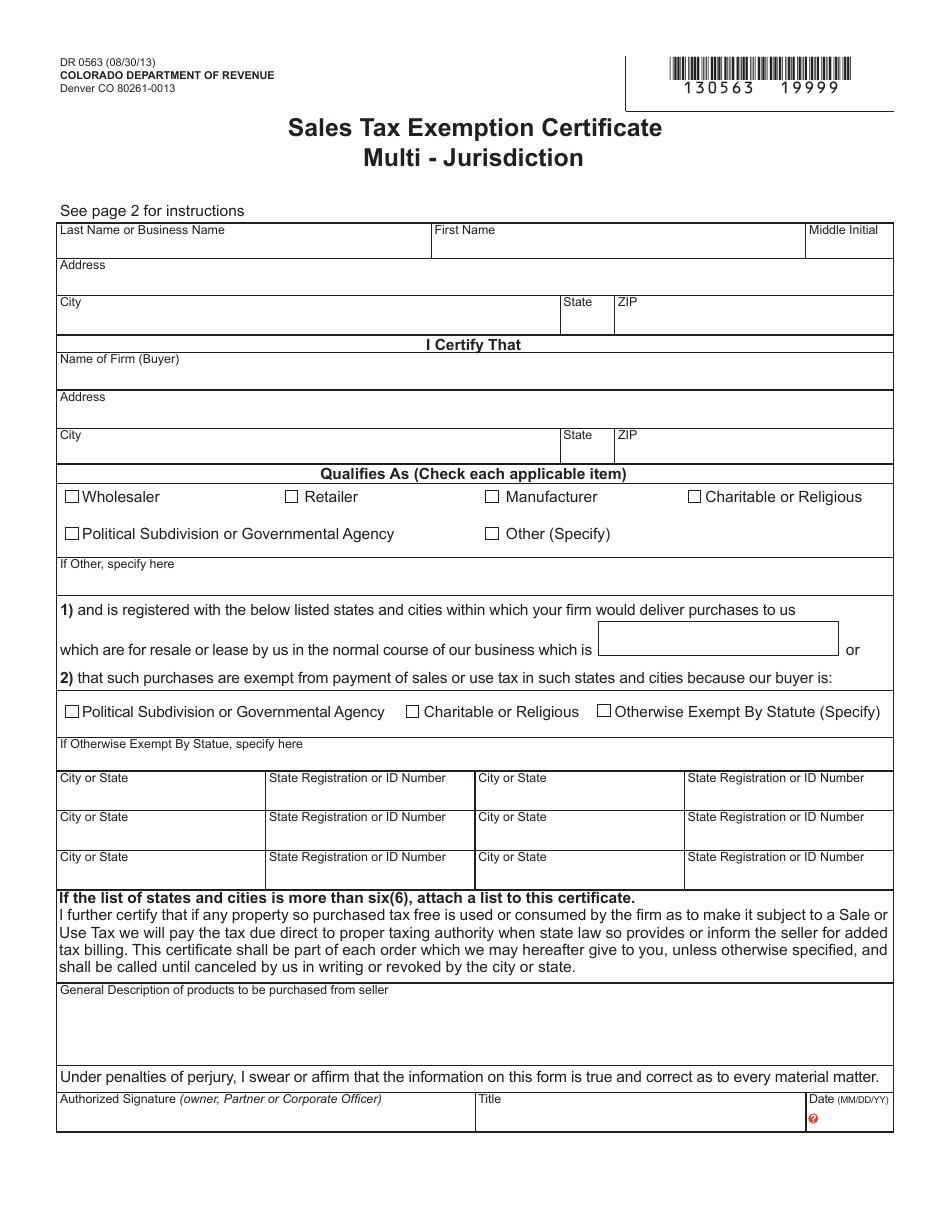

Form Dr0563 Download Fillable Pdf Or Fill Online Sales Tax Exemption Certificate Multi Jurisdiction Colorado Templateroller

A New Era In Death And Estate Taxes

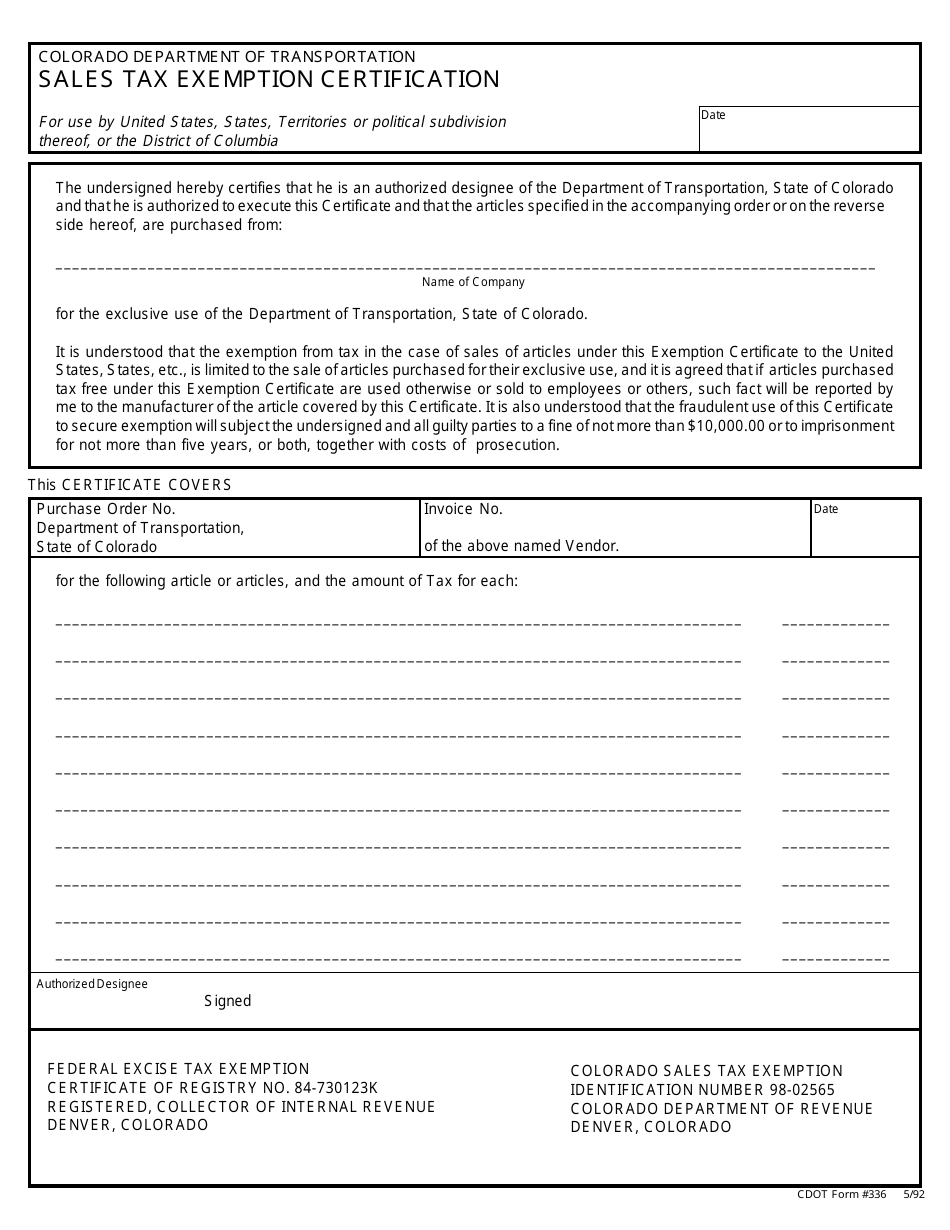

Cdot Form 336 Download Printable Pdf Or Fill Online Sales Tax Exemption Certification Colorado Templateroller

What Is A Homestead Exemption And How Does It Work Lendingtree

2020 Estate Planning Update Helsell Fetterman

Quit Claim Deed Pdf Quites Quitclaim Deed Words

How Do State Estate And Inheritance Taxes Work Tax Policy Center

Recent Changes To Estate Tax Law What S New For 2019

:max_bytes(150000):strip_icc()/dotdash_Final_Tax_Equivalent_Yield_Nov_2020-01-c528a1d54d4f48f19113104ac3291de1.jpg)

Tax Equivalent Yield Definition

Don T Let Higher Estate Tax Exemptions Make You Complacent About Transition Planning Valuation Buysellagreements Bus Estate Tax Tax Exemption How To Plan

Property Tax Exemption Who Is Exempt From Paying Property Taxes

2020 Estate Planning Update Helsell Fetterman

/dotdash_Final_Tax_Equivalent_Yield_Nov_2020-01-c528a1d54d4f48f19113104ac3291de1.jpg)

Tax Equivalent Yield Definition

Eight Things You Need To Know About The Death Tax Before You Die

How To Avoid Estate Taxes With A Trust

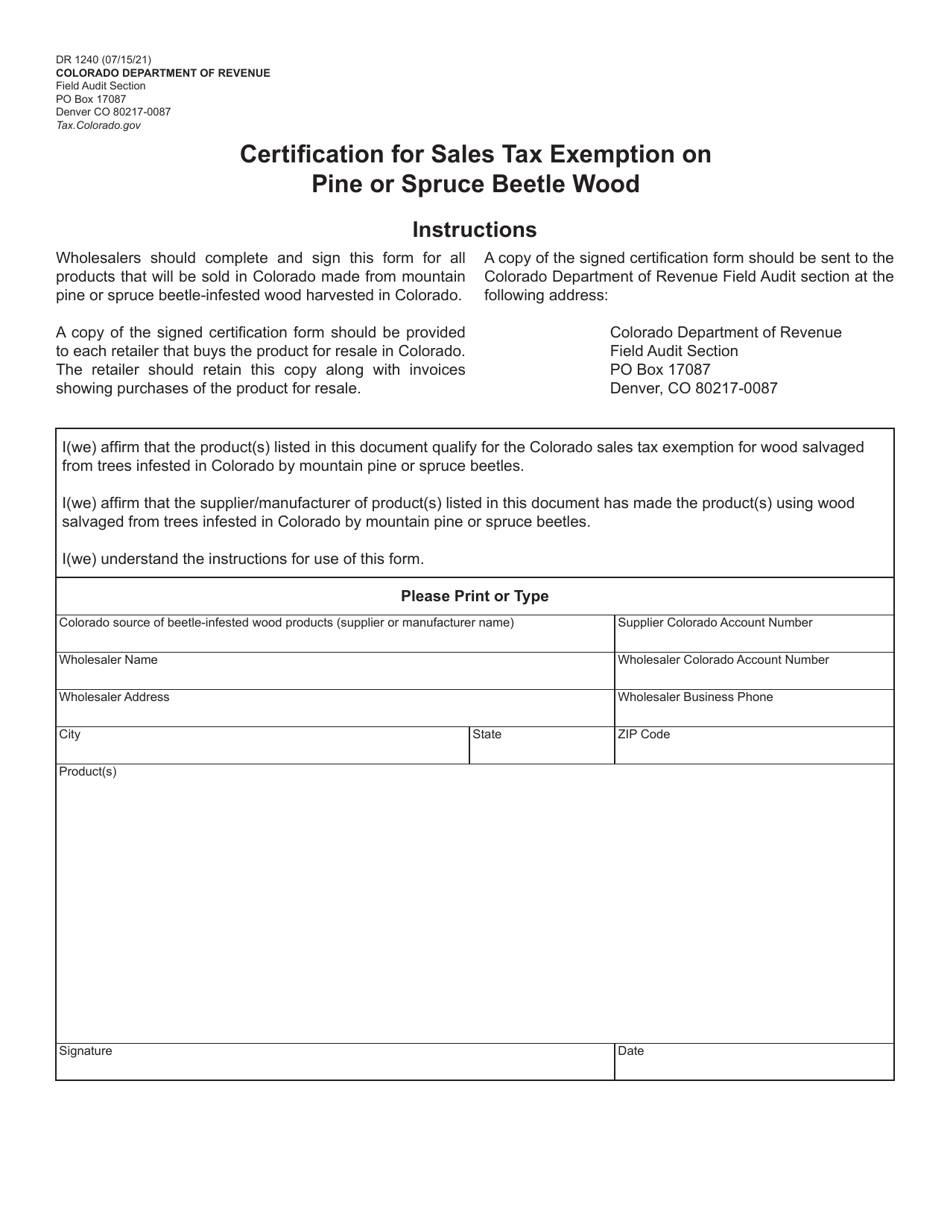

Form Dr1240 Download Fillable Pdf Or Fill Online Certification For Sales Tax Exemption On Pine Or Spruce Beetle Wood Colorado Templateroller